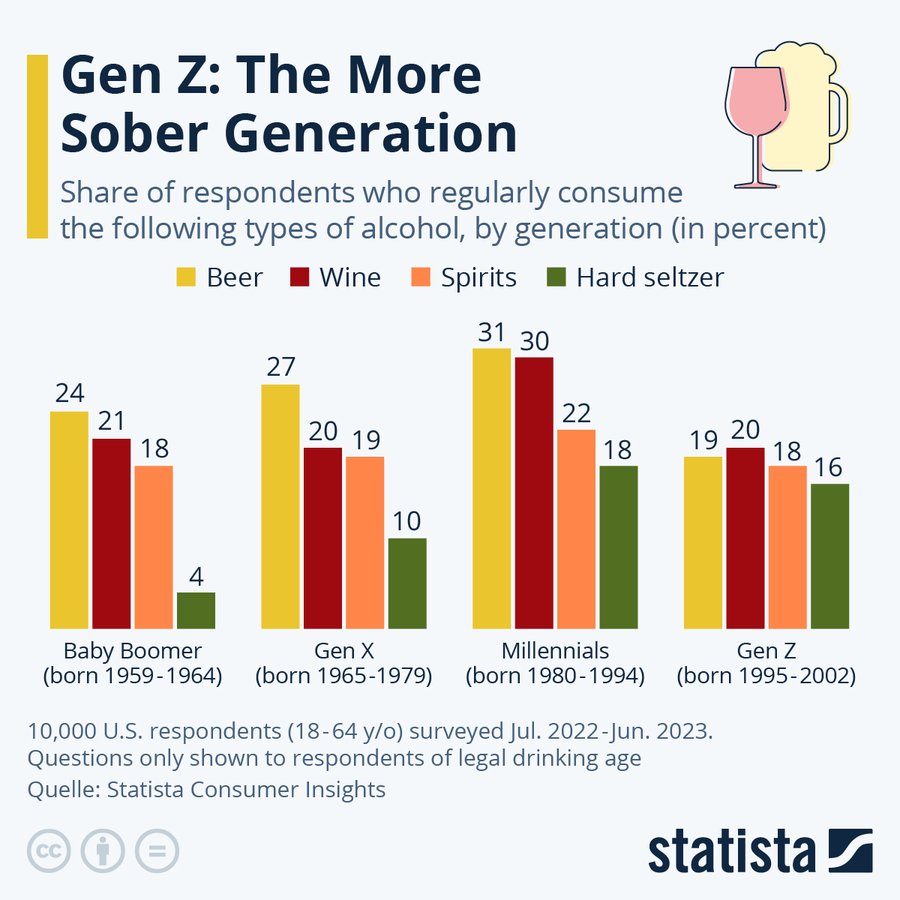

Only 38% of Gen Z adults in the US say they drank alcohol in the past month, compared to 52% of Millennials and 62% of Gen X at the same age, according to Gallup. In the UK, drinking among 16- to 24-year-olds has dropped by a fifth since 2016. The same story plays out in Australia, Canada, and Western Europe. Young people now chase health trends, mental clarity, and sugary mocktails instead of a cold beer.

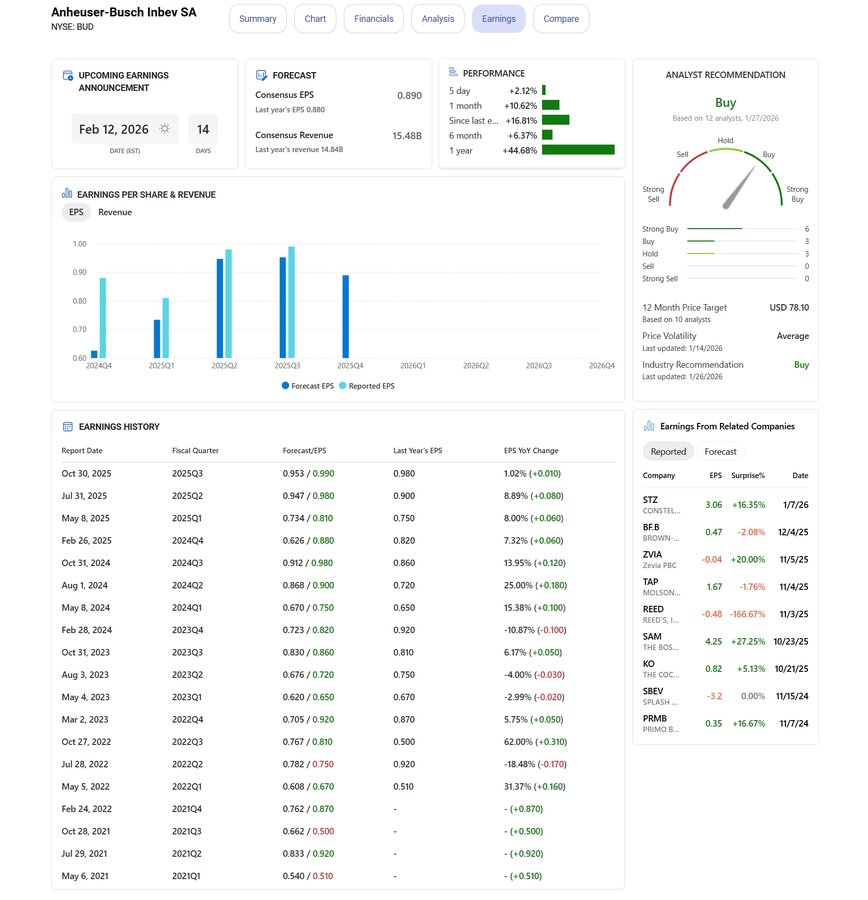

The result? Warehouses full of unsold alcohol. Anheuser-Busch InBev admitted to more than $2 billion in unsold stock in 2025. Diageo wrote off $1.4 billion in spirits. Small breweries and distilleries shut their doors last year, and even the big players are being warned they might have to close plants if this keeps up.

No evidence exists of a massive coordinated global campaign to make Gen Z or Gen Alpha more interested in drinking, as some have shared on social media.

Instead, brands are adapting by expanding into non-alcoholic and low-alcohol products, which IWSR forecasts will become the second-largest beer category by 2026.

Guinness (the greatest beer) has gained traction with Gen Z via experiential events like festivals, while CleanCo promotes sober lifestyle choices. Bacardi's 2026 trends report notes young drinkers prefer lighter "daycaps" and mood-based cocktails.

Public health experts criticize any subtle targeting of youth, citing risks of liver disease and addiction. NielsenIQ reports that 40% of U.S. consumers plan to participate in Dry January in 2026, with Gen Z at 50%. The industry will have to survive by following consumer shifts rather than forcing old habits on new generations.

The steady drop in alcohol use among Gen Z and Gen Alpha is a real problem for investors. Big names like Anheuser-Busch InBev, Diageo, and Constellation Brands could soon be stuck with mountains of unsold product and shuttered factories if this keeps up. Non-alcoholic and low-alcohol drinks are taking off, while old-school beer and spirits are flatlining or shrinking.